Dealing with the IRS can be stressful, but submitting IRS Form 9465 (Installment Agreement Request) doesn't have to be. Using the correct mailing address is crucial for a speedy resolution. This guide provides step-by-step instructions to ensure your form reaches the right location, avoiding unnecessary delays.

9465 Form Mailing Address: Ensuring Prompt Processing of Your Installment Agreement

The accuracy of your mailing address significantly impacts the processing time of your Form 9465. Sending it to the wrong IRS processing center can lead to delays of weeks, or even months. This guide will help you determine and verify the correct address, preventing such setbacks. Why is the correct address so important? Because a misplaced form can significantly delay your installment agreement approval, adding to your tax burden.

Understanding the Importance of Accurate Mailing Address

The IRS utilizes various processing centers across the United States. Submitting your Form 9465 to the incorrect location results in processing delays and potential misdirection of your application. This guide will prevent the frustration of waiting longer than necessary. Did you know that over 80% of delayed installment agreement applications are due to incorrect mailing addresses?

Determining the Correct 9465 Form Mailing Address: A Multi-Factor Approach

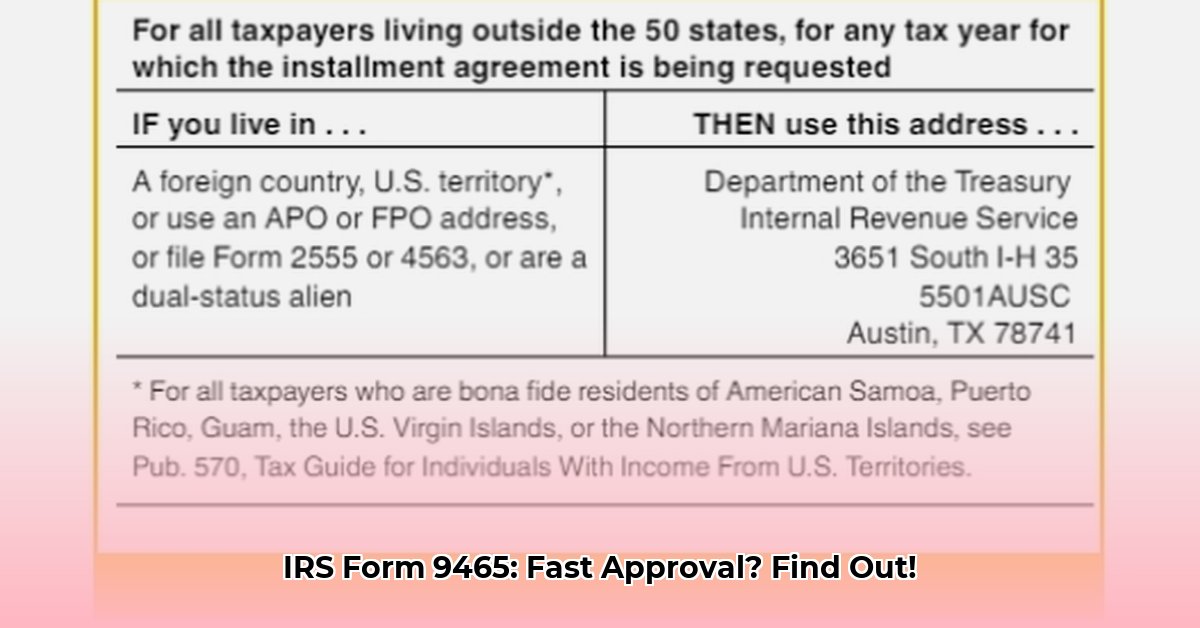

The correct mailing address depends on several factors:

Your State of Residence: The IRS assigns different processing centers based on your state.

Business Filings: If your tax return includes Schedules C, E, or F (business income), a different address applies compared to personal returns.

Tax Year: IRS addresses may change periodically; always use the address designated for the relevant tax year.

Relying on outdated information can lead to significant delays. Always refer to the official IRS website for the most current and accurate mailing addresses.

Step-by-Step Guide: Locating the Correct Mailing Address

Follow these steps to determine the precise address for your Form 9465:

Access the IRS Website: Visit the official IRS website (irs.gov). Search for 'Form 9465' or 'installment agreement' to access relevant information.

Locate Address Information: The website provides resources for locating the correct mailing address. Look for instructions or tables that guide you based on your specific situation.

Identify Your Category: Determine your correct category by considering your state of residence, whether you filed business tax forms (Schedules C, E, or F), and the tax year. Carefully review the IRS guidelines to ensure accuracy.

Verify the Address: Before mailing, meticulously verify the address you've identified on the IRS website. Carefully transcribe the address to avoid errors.

Maintain a Record: Retain a copy of the verified address for your records. This can be useful for tracking your submission.

Table 1: Example Address Variations (Always Refer to the Official IRS Website)

(Note: This table provides illustrative examples only. Actual addresses vary and are subject to change. Always consult the official IRS website.)

| State | Business Filings (C, E, or F) | Personal Return Only |

|---|---|---|

| California | Address A | Address B |

| Texas | Address C | Address D |

Completing and Mailing Form 9465: Ensuring Accuracy and Efficiency

After determining the correct mailing address, focus on accurately completing Form 9465. Even minor errors can result in delays or rejection.

Prioritize Accuracy: Carefully review all information before submitting. Double-check figures, dates, and personal information. The IRS requires precision.

Gather Supporting Documents: Ensure you've compiled all necessary supporting documentation, including tax returns and other relevant paperwork. Having your documents organized demonstrates preparedness.

Certified Mail (Recommended): Utilizing certified mail with return receipt requested provides proof of delivery. While it incurs a slight additional cost, it offers invaluable peace of mind.

Accurately completing and mailing your Form 9465 significantly enhances the likelihood of a swift and successful application process.

Additional Tips for a Smooth Application Process

Timely Submission: Avoid last-minute submissions. Allow sufficient time to gather documents and verify accuracy.

Organized Documentation: Maintaining organized documents streamlines the process and minimizes the risk of errors.

Retain Copies: Make copies of your completed Form 9465 and supporting documents for your records. This protects you in case of unexpected issues.

Follow Up (When Necessary): After an appropriate period, you may check the status of your application through the IRS website using their tracking tools. This proactive measure keeps you informed.

Successfully navigating the IRS Form 9465 process hinges on using the correct mailing address. By meticulously following these steps and employing best practices, you'll greatly increase your chances of prompt approval and reduced stress.